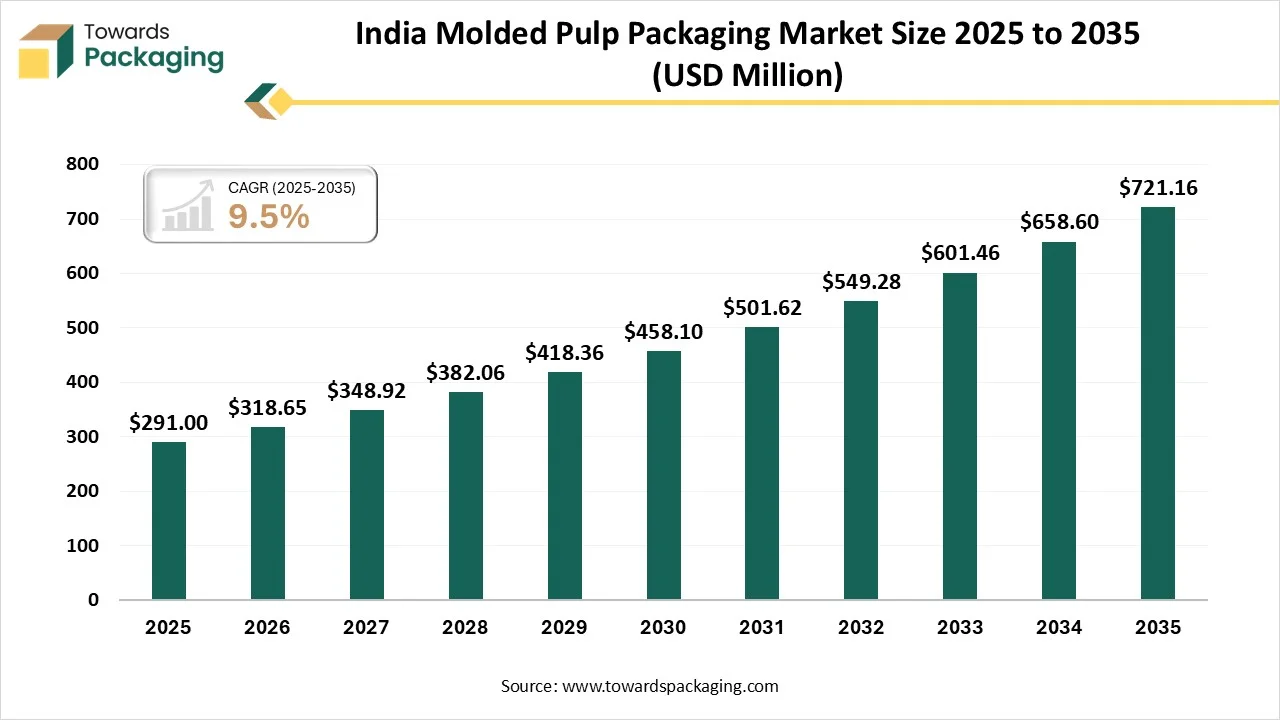

India Molded Pulp Packaging Market Size and Growth Forecast at a CAGR of 9.5% (2025–2035)

According to Towards Packaging consultants, the India molded pulp packaging market is projected to reach approximately USD 721.16 million by 2035, increasing from USD 291 million in 2025, at a CAGR of 9.5% during the forecast period 2026 to 2035.

Ottawa, Feb. 20, 2026 (GLOBE NEWSWIRE) -- The global India molded pulp packaging market size stood at USD 291 million in 2025 and is projected to reach USD 721.16 million by 2035, according to a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by the Molded Pulp Packaging?

Molded pulp packaging is an eco-friendly alternative to plastic, made from recycled paper or natural fibers mixed with water, molded into custom shapes for protective cushioning, and dried. It's valued for excellent protection for fragile goods and versatility, used for everything from egg cartons and electronics inserts to tableware and industrial components, offering a greener choice over foam and plastic.

Indian Government Initiatives for the Molded Pulp Packaging Industry:

- National Mission on Sustainable Packaging Solutions: Launched by the CSIR in 2024, this mission focuses on a net-zero future by developing innovative sustainable materials and advanced testing facilities.

- Plastic Waste Management (Amendment) Rules, 2022: This framework mandates Extended Producer Responsibility (EPR), forcing brands to transition toward eco-friendly materials like molded pulp to meet mandatory recycling targets.

- Single-Use Plastic (SUP) Ban: The nationwide ban on specific plastic items such as cutlery and trays has created a massive market surge for molded fiber and pulp-based alternatives.

- National Packaging Initiative: Managed by the Ministry of Commerce and Industry, this initiative supports domestic businesses in manufacturing sophisticated packaging materials and developing specialized logistics parks.

- BioE3 Policy (2024): This policy promotes high-performance bio-based manufacturing by incentivizing the use of agricultural residues to create biodegradable packaging.

- Plastic Industry Subsidy 2025 (MSME Focus): This scheme provides a 25–30% capital subsidy on plant and machinery for units transitioning to biodegradable and eco-friendly manufacturing.

- Production Linked Incentive (PLI) Scheme for Food Processing: This initiative incentivizes the use of sustainable packaging by supporting food manufacturing champions who use domestically sourced, green materials.

- EcoMark Certification Scheme: Administered by the Bureau of Indian Standards (BIS), this scheme identifies and certifies environmentally friendly products, helping molded pulp manufacturers gain market credibility.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5984

What Are the Latest Key Trends in the India Molded Pulp Packaging Market?

- Sustainability & Regulations: Increased environmental awareness and government regulations prohibiting single-use plastics are driving the adoption of molded pulp.

- Technological Advancement: The market is moving beyond basic, unorganized, and traditional molded pulp towards advanced thermoformed molded pulp, which provides a better finish and precision.

-

Raw Material Shift: While recycled fiber holds a large share, there is a growing trend toward using agricultural waste in manufacturing, which is more cost-effective and environmentally friendly.

What is the Potential Growth Rate of The Indian Molded Pulp Packaging Industry?

The Indian molded pulp packaging industry is experiencing high growth, driven by a strong shift toward sustainable, eco-friendly, and plastic-free alternatives. The primary drivers include the rising demand for sustainable packaging, strict government regulations against single-use plastics, and the rapid expansion of the food delivery sector. Other key growth drivers are the need for biodegradable, protective packaging for electronics, food, and perishables, alongside rising consumer awareness regarding environmental impact.

More Insights of Towards Packaging:

- Polyethylene Films Market Size, Trends and Volume (2026-2035)

- Thin Wall Packaging Market Size and Segments Outlook (2026–2035)

- Dunnage Packaging Market Size, Trends and Segments (2026–2035)

- Liquid Packaging Market Size and Segments Outlook (2026–2035)

- Food Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Seed Packaging Market Size and Segments Outlook (2026–2035)

- Europe Pharmaceutical Glass Packaging Market Size, Trends and Segments (2026–2035)

- Uncoated Paperboard For Luxury Packaging Market Size and Segments Outlook (2026–2035)

- Consumer Packaged Goods (CPG) Market Size, Trends and Competitive Landscape (2026–2035)

- Automotive Parts Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- North America Yogurt, Cheese & Meat FFS Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Black Rigid Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Refillable Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Dairy Product Packaging Market Size and Segments Outlook (2026–2035)

- Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Regional Analysis (2026–2035)

Segment Outlook

Source Type

How Did Wood Pulp Segment Dominate the India Molded Pulp Packaging Market?

The wood pulp segment dominated the market in 2025, due to its consistent fiber quality, established supply chains, and suitability for producing strong, durable packaging formats. Manufacturers prefer wood pulp for applications requiring structural rigidity and protection, particularly in food service trays and protective industrial packaging. Rising environmental awareness and improvements in sustainable forestry practices further support its continued use, while domestic processing capabilities ensure steady availability for converters.

The non-wood pulp segment is projected to grow at the fastest rate in the market for the forecast period, as it is gaining significant traction in India as sustainability and circular economy initiatives intensify. The abundant availability of agro-waste and government encouragement toward waste valorization make this segment attractive. Producers are increasingly investing in technologies that enhance fiber strength and finish, enabling non-wood pulp to compete with traditional materials in food packaging, disposable tableware, and healthcare applications.

Molded Type

Which Molded Type Segment Dominates the India Molded Pulp Packaging Market?

The transfer-molded segment dominated the market in 2025, owing to its cost-effectiveness and suitability for mass production. This method is widely used for protective packaging such as egg trays, fruit trays, and industrial cushioning solutions. Manufacturers benefit from lower tooling costs and scalable production volumes, making transfer molding popular among small and mid-sized converters serving agriculture, electronics, and FMCG supply chains.

The thermoformed segment is projected to grow at the fastest rate in the market for the forecast period, due to increasing demand for premium appearance, smoother finishes, and precise shapes. Food delivery services, organized retail, and quick-service restaurants are major adopters. The process allows thinner walls, improved aesthetics, and better branding opportunities, aligning well with the shift toward high-quality, sustainable alternatives to single-use plastics.

Product Type

How Did Trays Segment Dominate the India Molded Pulp Packaging Market?

The trays segment dominated the market in 2025, as they are extensively used across egg packaging, fruit handling, electronics cushioning, and ready-to-eat food services. Their ability to provide shock absorption, stackability, and ventilation makes them highly functional. Rising growth in organized retail, e-commerce logistics, and food delivery platforms continues to stimulate strong and consistent demand for tray formats.

The bowls & cups segment is projected to grow at the fastest rate in the market for the forecast period, supported by the replacement of plastic disposables in institutional catering, railways, airlines, and takeaway food services. Increasing regulatory pressure on single-use plastics and heightened consumer preference for biodegradable options are accelerating adoption. Manufacturers are improving barrier coatings and structural integrity to make molded pulp bowls and cups suitable for hot and cold food applications.

End-User Industry

Which End User Segment Dominates the India Molded Pulp Packaging Market?

The food packaging segment dominated the market in 2025, driven by the growth of quick-service restaurants, cloud kitchens, supermarkets, and fresh produce distribution. Molded pulp solutions are valued for their biodegradability, compostability, and ability to protect fragile items during transit. With sustainability becoming a purchasing priority for both brands and consumers, demand continues to rise across urban and semi-urban markets.

The healthcare & medical devices segment is projected to grow at the fastest rate in the market for the forecast period, as it is emerging as a promising growth area, using molded pulp for sterile packaging, instrument trays, and protective cushioning. Hospitals and device manufacturers are adopting eco-friendly materials to align with environmental targets while ensuring safe transportation. Advancements in cleanliness standards, custom molding precision, and protective performance are strengthening the segment’s future potential.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Recent Breakthroughs in the India’s Molded Pulp Packaging Industry

In October 2025, Allimand and Pakka Limited announced a partnership to construct a sustainable paper machine (PM4) at Pakka’s facility in Ayodhya, Uttar Pradesh, India. The project, part of a larger ₹675 crore expansion, aims to produce eco-friendly paper for flexible packaging from agricultural residues, with production scheduled to begin in 2026.

Top Companies in the India Molded Pulp Packaging Market & Their Offerings:

- Maspack Limited: Manufactures diverse molded pulp products, including egg and fruit trays and protective industrial inserts for electronics and bottles.

- Pulp2pack: Specializes in custom-engineered protective solutions like molded pulp corner guards, shoe fillers, and industrial trays for secure shipping.

- Neeyog: Provides eco-friendly disposable packaging such as molded pulp meal trays, egg cartons, and various bagasse-based food containers.

- Discover India Packaging: Offers sustainable alternatives to plastic fitments through molded paper pulp products designed for retail and industrial applications.

- Cirkla, Inc.: Delivers high-performance molded fiber solutions like dairy tubs, meat packaging, and ready-meal trays made from plant-based fibers.

- Huhtamaki PPL Limited: Produces advanced molded fiber trays and recyclable packaging components for the food, beverage, and personal care sectors.

- JK Paper Ltd.: Manufactures premium virgin pulp boards used primarily for high-end sustainable cartons and industrial packaging solutions.

- Pakka Limited: Focuses on compostable food serviceware, including molded fiber trays and containers specifically for the catering and restaurant industries.

- Ecoware: Produces a wide range of 100% biodegradable tableware, such as molded pulp plates and bowls made from sugarcane bagasse.

- Bamboo India: Supplies bamboo-based sustainable packaging and molded products designed to replace single-use plastics in daily consumer use.

- Bambrew: Creates plant-fiber-based e-commerce packaging, including eco-friendly mailer bags, rigid boxes, and custom retail solutions.

- Vijay Industries: Manufactures natural tableware and packaging using areca leaf and banana fiber, along with the machinery to produce them.

-

Dinearth Eco-Friendly Tableware: Offers a variety of microwave-safe sugarcane bagasse products, including heat-resistant compartment trays and clamshell boxes

Segment Covered in the Report

By Source

- Wood Pulp

- Non-Wood Pulp (Bagasse, Wheat Straw)

By Molded Type

- Transfer Molded

- Thick Wall

- Thermoformed

- Processed/Slim Wall

By Product Type

- Trays

- Bowls & Cups

- Clamshells

- Plates

- End Caps & Inserts

By End-User Industry

- Food Packaging

- Healthcare & Medical Devices

- Consumer Electronics

- Foodservice

- Industrial Goods

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

North America Stick Packaging Market Size and Segments Outlook (2026–2035)

Hot Drinks Packaging Market Size, Trends and Regional Analysis (2026–2035)

U.S. Molded Pulp Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Vaccine Storage Packaging Market Size, Trends and Segments (2026–2035)

Intelligent Packaging Market Size, Trends and Segments (2026–2035)

Plastic Packaging Market Size and Segments Outlook (2026–2035)

Lightweight Industrial Corrugated Packaging Market Size and Segments Outlook (2026–2035)

Sustainable Aerosol Packaging Market Size, Trends and Segments (2026–2035)

Poly-Woven Packaging Market Size, Trends and Segments (2026–2035)

Mono-Material Cosmetic Tubes Market Growth, Trends & Forecast (2025-2035)

U.S. Beer Packaging Market Size and Trend, Segment Outlook (2026–2035)

Cold Chain Packaging Refrigerants Market Size, Trends and Segments (2026–2035)

Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

Heavy-Duty Corrugated Bulk Boxes Market Size and Segments Outlook (2026–2035)

Next-Gen Paper & Fiber-Based Packaging Market Size, Trends and Regional Analysis (2026–2035)

Flow Wrap Packaging Market Size, Trends and Competitive Landscape (2026–2035)

India Molded Pulp Packaging Market Size, Trends and Segments (2026–2035)

Clear Plastic Film Market Size, Volume, Price and Trends (2026 - 2035)

Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44; Request Research Report Built Around Your Goals: sales@towardspackaging.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.